Search

for the transaction fee rule that you want to edit.

Click the Edit

icon  in

the row of the transaction fee rule you want to edit.

in

the row of the transaction fee rule you want to edit.

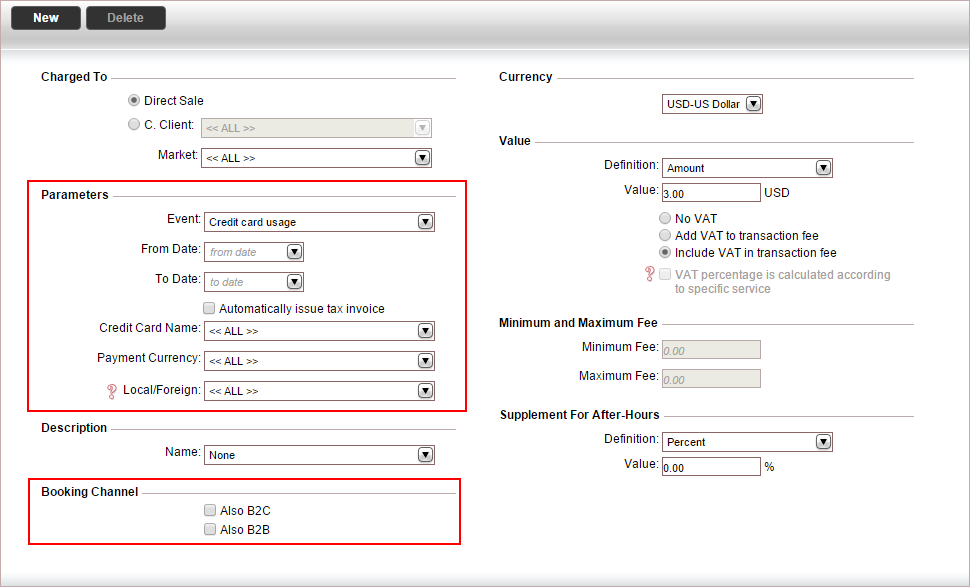

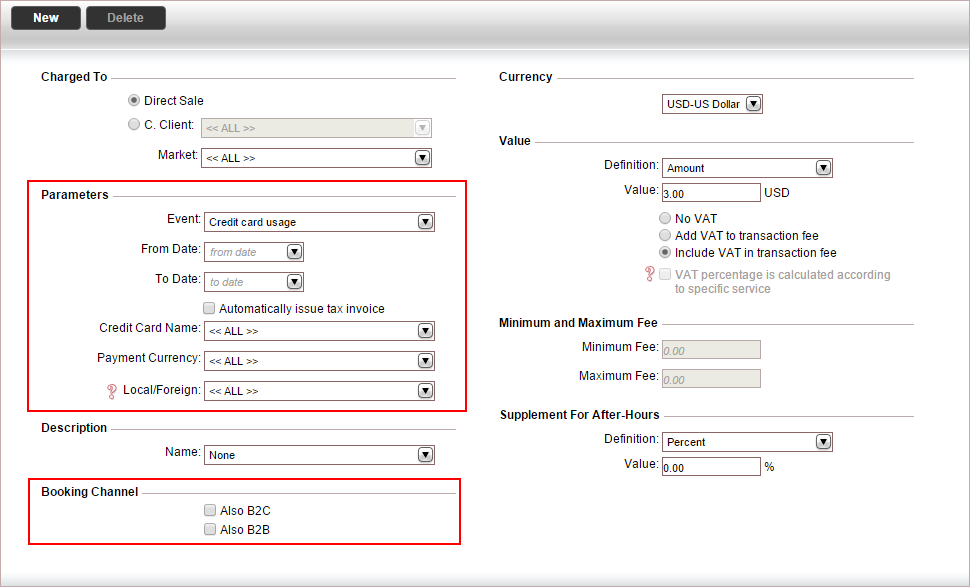

The transaction fee rule is displayed.

In the Parameters section, in the Event field, select Credit

Card Usage.

Define the transaction fee parameters.

Field |

Description |

From Date |

The beginning of the transaction fee validity date range. |

To Date |

The end of the transaction fee validity date range. |

|

More specific transaction fee rules

override general transaction fee rules. |

If you want a tax invoice to be issued automatically

when the transaction fee is added to a travel file, select Automatically

issue tax invoice.

|

If you select this option, in the reservations

system, if you cancel a receipt that was issued for a credit

card payment, then any Credit

Card Usage transaction fees are also deleted and the

tax invoices are cancelled.

This only applies if an invoice for the

fees was not issued. |

If credit cards used for payment incur different

transaction fees, in the Credit Card

Name field, select the credit

card relevant to this transaction fee.

|

If your site redirects to a payment

gateway for processing credit card payments, the credit card

selected by the customer for payment cannot be identified.

In such a case you need to define a single Credit

Card Usage transaction fee for all

credit card companies. |

If you want to apply the transaction fee to purchases

made in a specific currency, in the Payment

Currency field, select a currency from the drop-down list.

If you want to apply the transaction fee only

to local or only to foreign credit cards, in the Local/Foreign

field, select the relevant option from the drop-down list.

If you want the transaction fee rule to also apply

to the B2B and B2C selling channels, in the Booking

Channel section, select the relevant selling channels.

Click Save and

Exit, or continue to select the transaction

fee description.

in

the row of the transaction fee rule you want to edit.

in

the row of the transaction fee rule you want to edit.

Click here for a detailed example.

Click here for a detailed example.