To access and perform actions in the module:

Contact your project manager to activate the module

Assign the permit Perform actions in Installments Fee module to the user(s)

To access and perform actions in the module:

|

This procedure explains how to enable B2E and B2C customers to pay for transactions in installments, and how to define the interest amounts that customers are going to be required to pay as installment fees for selecting this payment method.

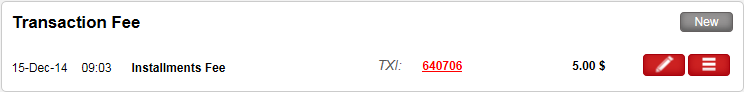

In the Reservations System, the installments fee can be viewed in the Travel File, in the Transaction Fee section. The definitions in this module (name, VAT, automatic tax invoice) will apply to the entry that is created in this section.

Note installments are enabled only for the Credit2000 and CreditGuard interfaces. |

Go to Business Rules - Installments Fees.

Enabled needs to be selected at the end of this procedure. |

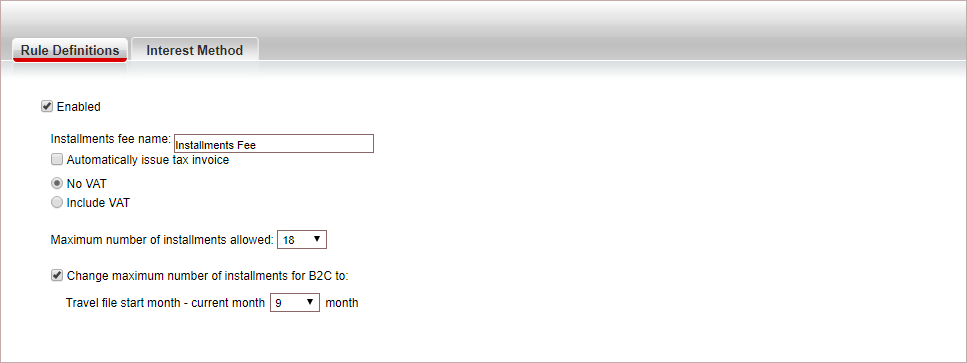

In the Installments fee name field, enter the name for the installments fee to be displayed in the Travel File (In other words, names such as, Installments Fee, Installments Surcharge, or Additional Installments Payment).

If you want a tax invoice to be automatically issued with the installments fee, select Automatically issue tax invoice.

|

If you select this option, in the reservations system, if you cancel a receipt that was issued for a credit card payment, then any installment fees are also deleted and the tax invoices are cancelled. This only applies if an invoice for the fees was not issued |

Select a VAT option:

No VAT: No VAT is charged for the installments fee.

Include VAT: The VAT is included in the installments fee.

If there is a credit card usage transaction fee rule defined in the system, with the same VAT definition that is defined in this mechanism, when issuing the receipt a single transaction fee is created in the travel file for the total amount of both the credit card usage fee and the installment fee from which a single tax invoice can be issued. If the fees are in different currencies, the transaction fee amount ןד converted to the travel file currency. All other definitions will be applied to the fee as if this were a transaction fee. |

In the Maximum number of installments allowed field, select the maximum number of installments that can be selected when issuing a receipt in the Reservations System.

The number of installments selected in this field will appear in the Reservations System,even if the Installments Fee module is not enabled. |

B2C only. If you want to enable a separate method for calculating the maximum number of installments based on the relative difference between the travel start month and the month when the booking is made, select Change number of installments for B2C to: Travel file start month - current month, and then enter the number of months to be added/subtracted from this amount.

This option applies only to regular

installments, not credit installments. |

Select the Interest Method tab.

Select the method for charging interest on the installments:

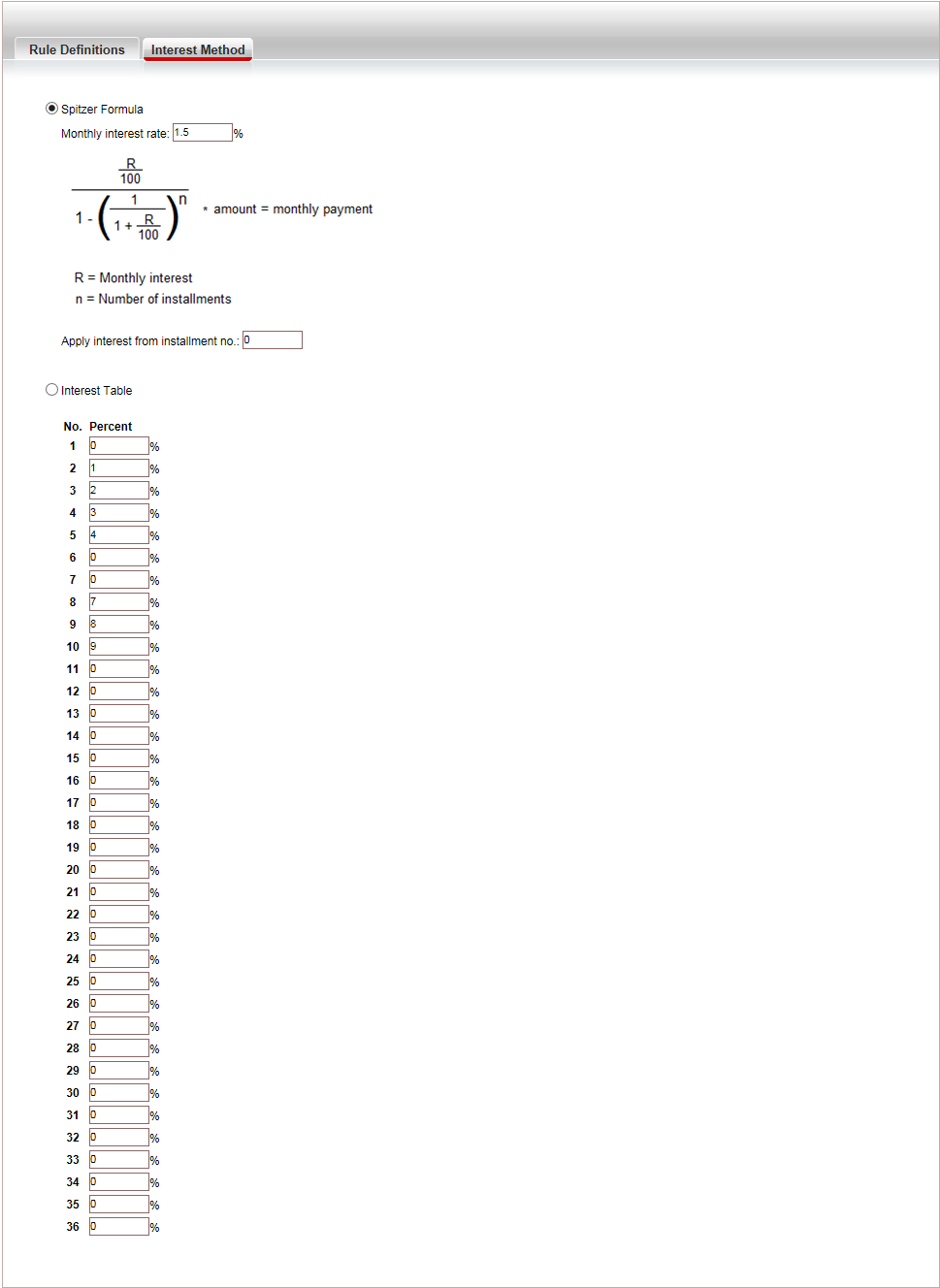

Spitzer Formula:

In the Monthly interest rate field, enter the monthly interest rate.

In the Apply interest from installment no field, enter the number of installments from which interest will be applied.

Interest Table: In each row in the table, enter the interest percentage to be charged for each installment, according to the number of installments selected in the Reservations System.

The number of rows in this table is determined according to what was selected in the Maximum number of installments allowed field. |

To enable the Installments Fees mechanism, in the Rules Definitions tab, select Enabled.

Click Save and Exit.