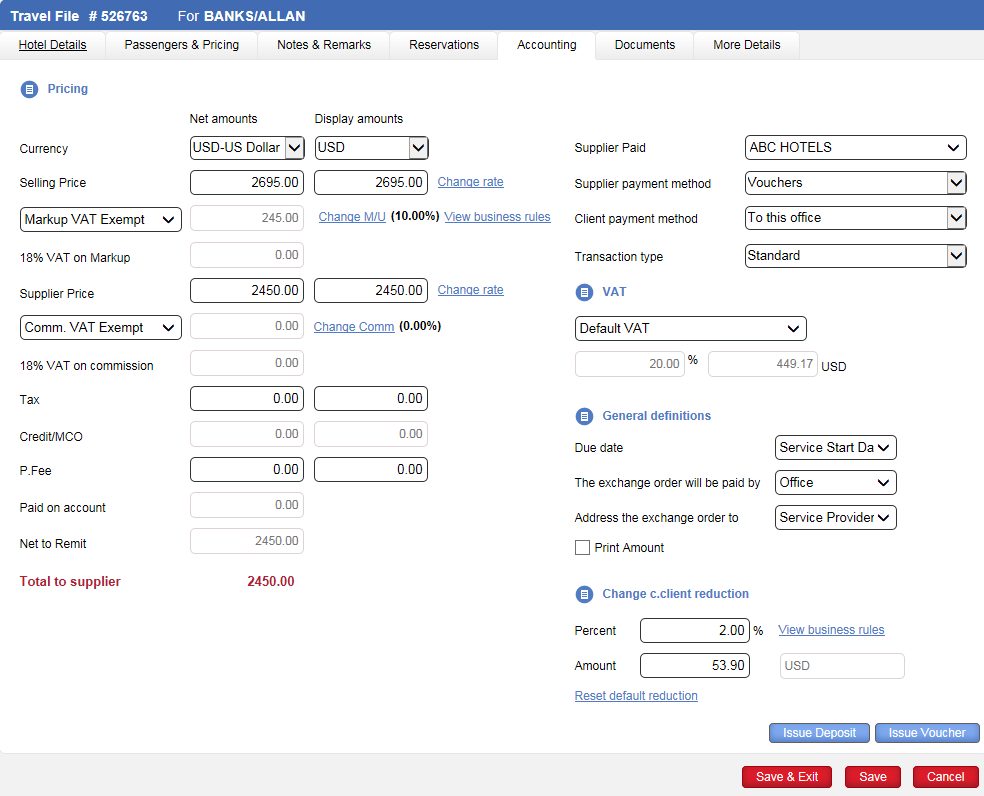

The Accounting tab summarizes the financial information of the transaction, including a total pricing break down, supplier payment information, VAT settings, voucher settings, and commission/reduction information.

The tab is divided into several sections.

In the Pricing section you can view the total pricing information of the transaction. Most service types are priced here. Services which have a pricing break down per passenger or per room (flights, hotels) are priced in the Passengers and Pricing tab, but you can still view the total cost of the transaction in this tab.

The section is divided into two columns:

Net amounts: Amount breakdown in the supplier currency as defined in the supplier’s account

Display amounts: Amount breakdown in the selling currency

You can edit the currency for each column. The currency you select in the Display amounts column is the currency in which the invoice will be issued. The currency in these columns is initialized from the Service Details tab, from the supplier that is defined in that tab. The currency can also be changed in the Passengers & Pricing tab.

The default markup and commissions amounts or percentages are taken either from the business rules, from the supplier account (manual transactions), or from the contract (if the transaction is from a contract). These amounts can be edited.

The amounts in each column are broken down as follows:

Field |

Description |

| Selling price | The total selling price of the transaction. You can click the Exchange Rate link to adjust the exchange rate between the supplier currency, the travel file currency and the system currency. |

| Markup | The markup that is added on top of the supplier price. |

| X% VAT on markup | In this field, if applicable, you can view the VAT that is added to the markup. |

| Supplier price | The total supplier price of the transaction. You can click the Exchange Rate link to adjust the exchange rate between the supplier currency, the travel file currency and the system currency. |

| Commission | The commission provided by the supplier. |

| Tax | Additional taxes that are charged for the service, such as airport taxes. |

| Credit/MCO | Credit or miscellaneous charge order (MCO) amounts. Only relevant, when the Client Payment Method is Credit Supp. or MCO. This is used when the customer pays the supplier directly (even partially), or when the customer has credit from the airline. |

| P. Fee | An amount that was paid in advance to the supplier. |

| Paid on account | An amount that was received by the travel company for which a deposit document was issued. |

| Net to remit | The total amount that needs to be paid to the supplier after taking into account commissions, taxes, credit/MCO, prepaid fees. |

| Total to supplier | The total amount that needs to be paid to the supplier not including/excluding commissions. |

In the (upper-right corner) of this tab, you can view payment information relating to the supplier:

Supplier paid: The supplier who is paid for the transaction, which can be the same or different from the reserving supplier. For example with flight transactions, the service providers are the airlines, while the supplier paid is the BSP.

Supplier payment method: The method through which the supplier is paid, which can be vouchers (default), cash, MCO, BSP tickets, self-ticketing, supplier tickets, or international tickets.

The voucher, also known as an exchange order, is a document which creates a financial obligation to the supplier. Once the voucher is issued, the travel file is debited with the amount of the transaction, the supplier is credited, the Travel File Profit page is updated, incentive amounts can be transferred to user/freelancers, and the reconciliation process is triggered.

If the method of payment is cash, the travel file is immediately debited with the transaction amount when the transaction is created, and you will be required to pay the supplier immediately.

Client payment method: The method through which the client is paying for the transaction, which can be to the travel company (default), directly to the supplier, prepaid abroad, or MCO.

|

When the transaction is created from a PNR containing a credit card used as a form of payment in the GDS:

|

The VAT section is only relevant if you are working using the Sales and Purchases method. In order to display this tab, in the Administration Tools, in the Database Definitions, in the VAT page, select VAT on Travel Services.

In the VAT section, you can choose how to apply VAT to the transaction: No VAT, default VAT or edit the VAT percentage or amount.

The General Definitions section includes general information relevant for the exchange order (voucher, self-ticketing, BSP, etc.) of the transaction:

|

The fields in this section are initialized from the supplier account, and usually do not need to be edited. |

Due Date: The value (payment) date for the transaction – the issue date of the exchange order, the travel file start date, the service start date, or the service end date.

The exchange order will be paid by: A remark that appears on the footer of the exchange order regarding who will be paying for the transaction:

Client – the travel agent/corporate client will pay the supplier

Supplier Paid – nothing is written on the exchange order, and the travel agent/corporate client pays the supplier directly

Office – the travel company

Define in remark – the remark will state who is paying for the transaction.

Address the exchange order to: Select who to address the exchange order to, the service provider or the supplier paid

Print Amount: Select this option if you want to print the amount of the transaction on the exchange order

The fields in this section are initialized from the supplier account, and usually do not need to be edited.

In the Change Agent Commission/C. Client Reduction section, you can add/edit the commission/reduction of the transaction. The default commission/reduction is taken from the business rules, which you can view by clicking the View business rules link.

After editing the commission/reduction, you can restore the default amount by clicking the Reset default commission link.

Finally, in this tab you can use the Issue Deposit button to issue a deposit to the supplier, and Issue Voucher button to issue a voucher or ticket to the supplier.

After the voucher is issued, if necessary you can issue a refund request by clicking the Issue Refund button. The refund can be for all or part of the transaction. With flights, you have the option of issuing a refund for specific passengers or specific legs.

If the supplier payment method is Cash, instead of an Issue Voucher button, there is an Issue PRQ button through which you can issue a payment requisition to the supplier.

|

The Supplied Paid tab is displayed here as well (in addition to the Passengers & Pricing tab). Updating this field in one tab will change in parallel the other tab as well. |