In order to change the definitions, please contact your project manager at Galor.

In order to change the definitions, please contact your project manager at Galor. |

This page is used to define the VAT definitions which are used in the system.

There are two methods for applying VAT, which depend on whether the option VAT on travel services is selected:

Selected: VAT is applied to the entire selling price

Not selected: VAT is only applied to the profit.

There are two formulas for calculating VAT in the system:

Sales and Purchase method OR Markup/Commission including VAT: Total amount * (VAT%/(100 + VAT%)) = VAT amount

For example, the VAT is 18%. If the total amount is 30, the VAT is 4.58.

30 * (18/(100 + 18)) = 4.5762. This amount is rounded to 4.58. The total amount before VAT is calculated as the total amount – VAT. In the example above, the total amount before VAT is 25.42.

Markup/Commission + VAT: VAT% * commission amount

For example, the VAT is 18%. If the total markup/commission amount is 30, the VAT is 5.4.

30*0.18 = 5.4.

In the Official VAT on commission and markup field, enter the default VAT percentage.

This option is only relevant if VAT on travel services is selected.

Select a country in this field to only apply VAT to transactions with a destination in this country. This is the country that is used for domestic purposes

This option is used to validate the VAT number according to the official formula in the country where the office is located.

This option is applicable for VAT numbers entered in Travel Agent / C.Client Accounts, or company-based client entity (a commercial entity that makes payment in the travel file).

Select the option and the country code from the drop-down list.

The options in this section are activated only when VAT on Travel Services is selected.

The options in this section are activated only when VAT on Travel Services is selected.

Select Default VAT to apply the VAT amount defined in Official VAT on commission and markup field.

OR

Select Use the VAT table to apply different VAT amounts to different service types.

For each Service type, enter the VAT amount in the Percent field.

If required, in the VAT Code field, enter the VAT code as appears in the Code table.

If required, select Apply separate VAT per component type (applicable only for hotel) to apply different VAT amounts to specific hotel price components: Main, Board Basis, and Supplement.

This option is only relevant if VAT on Travel services is not selected.

Select this option to apply the VAT amount defined in the Official VAT on commission and markup field at the top of this page.

This option is only enabled if VAT on Travel Services is selected.

Select this option to apply a different VAT percentage for each service type. VAT is only applied to transactions with a destination in the Country for Domestic purpose.

Once you select this option, the VAT table without countries is displayed.

If required, select Apply separate VAT per component type (applicable only for hotel) to apply different VAT amounts to specific hotel price components: Main, Board Basis, and Supplement.

For each Service type, enter the VAT amount in the Percent field.

If required, in the VAT Code field, enter the VAT code as appears in the .

This table is used for defining VAT codes for use in the VAT table. These codes are displayed on the invoice.

Click Click here to add new remarks.

In the Code field, enter the code name.

In the Remark field, enter a description for the code name.

To delete

an existing code, click |

This option is relevant for all accounting methods.

This table allows you to define separate VAT percentages for different service types in different countries.

For example, you can define that the VAT on hotel services in the United Kingdom is 8%, while the VAT on hotel services in the European Union is 5%.

If this option is selected, when a transaction is reserved in the travel file, the system checks if there are relevant definitions in the table. If there is a matching service type and country, the definition in the table is applied. If there is no definition for the service type and country, the default VAT is applied.

The transaction country is determined from the transaction destination. When editing a transaction, if you change the destination and there is a matching VAT definition in the table, the default VAT in the transaction is recalculated.

To add a VAT definition to the table:

Click Click here to add a new item.

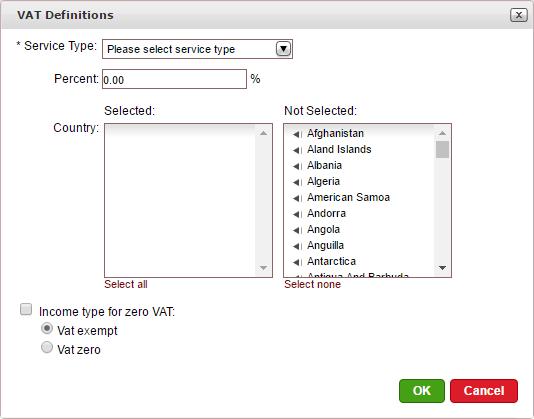

The VAT Definitions dialog box is displayed.

In the Service Type field, select the service type to which the VAT definition applies to.

In the Percent field, enter the VAT percentage.

In the country field, select the countries to which the VAT definition applies.

If no countries are selected, the VAT definition applies to all countries. You do not need to select all countries. |

If the VAT percentage is zero, select Income Type for zero VAT, and choose one of the following:

VAT exempt

VAT zero

If the transaction is reserved from a contract, the income type defined in the contract is used instead of the income type defined in the table. The Income Type for zero VAT definition in the table overrides the definitions in the supplier account. |

Click OK.

The VAT table with countries is updated.

If the transaction is reserved from a contract, the income type defined in the contract is used instead of the income type defined in the table. |

Select VAT on Package for Travel agency (on package country list) to select VAT for a travel agent travel file that contains a package service type. |

Select the VAT on Travel Services check box in order to manage your system according to Sales and Purchases.

Once this option is selected, the Default VAT section appears in the Service Definition page, in the supplier account, in the Advanced Definitions expander of contracts, and in the Accounting tab, of transactions in travel files in the Reservations System.

If this option is not selected, the VAT will be calculated according to the profit earned. If this option is selected, the VAT will be included in all prices. |

To apply VAT to taxes (for example, airport tax), select Apply VAT to tax.

To apply VAT only to domestic travel files, select Apply VAT only to domestic travel files. If this option is selected, in Financial - Export Data to General Ledger - General, in the Method section, the option Combined becomes enabled.

|

If this option is selected and a country is selected in the Country for domestic purpose field, if the destination of the travel file is the country selected, and the selling currency is the system currency, the travel file type is initialized as Domestic. |

Select this option if you are issuing an invoice that triggers the issue of a transaction fee tax invoice (TXI). The system will compare between the VAT percentages of all services in the travel file and will apply the highest VAT value to the transaction fees.

This option applies to Belgium VAT only. Select this option if you want to deduct Belgium VAT from your profits.

In the table you can select for each service type which income account will be used for commissionable transactions with markup.

The All row applies to all service types that are not specified in a separate row in the table.

For each row, you can select one of the following options:

According to commission account: The default VAT on the markup is calculated according to the option chosen for the commission (for example, if the commission does not include VAT, by default the markup will also not include VAT).

Include VAT: The default markup includes VAT

No VAT: The default markup does not include VAT.