The Travel File Profit page displays the profit in the travel file including a detailed breakdown of how that profit is calculated. The profit is based on the transactions and the documents that have been issued in the travel file. All amounts on this page are displayed in the Travel File Currency.

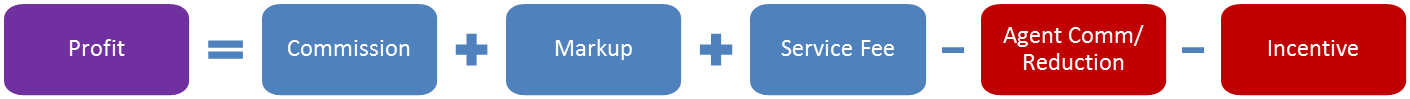

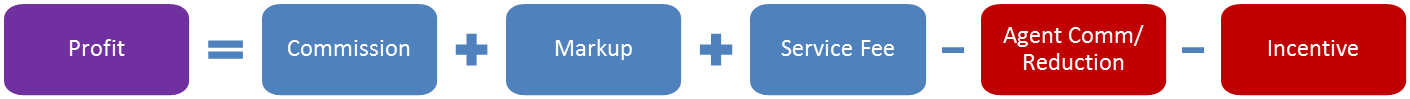

Profit is earned from commissions from suppliers, markup, transaction fees, and credit notes issued between the travel file and general and discount accounts . Commissions to travel agents, reductions to corporate clients and direct sales, incentives granted to users/freelancers, and debit notes issued between the travel file and general and discount accounts are deducted from the profit.

The header of this page displays both forecasted and actual profit amounts and percentages.

The travel file profit page is comprised of the following sections:

Services: This section displays a breakdown of all the amounts in the travel file according to service status

Invoices: This section displays a breakdown of all the amounts in the travel file according to invoices

User/Freelancer Incentive: This section displays the total amount of incentives owed to user and freelancers.

Summary: This section displays a summary of all the amounts that affect the profit in the travel file as well as other documents that affect the travel file balance.

Profit: This section displays the total actual and forecasted profit in the travel file.

Balance: This section displays a breakdown of the travel file balance.

If you are working with the Sales and Purchases accounting method, the Travel File Profit page is disabled. If VAT is applied only to domestic travel files, the Travel File Profit page is only disabled for domestic travel files. |

If VAT on Travel Services is enabled in markup based transactions, once the closing (final) voucher has been issued in the transaction, the profit calculation accounts for deduction of the VAT amount defined in the transaction from the markup. |

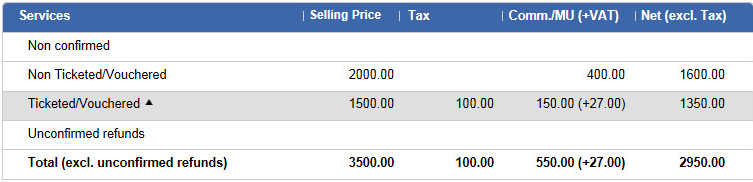

The Services section lists the breakdown of amounts for all the transactions in the travel file. The services add to the profitability of the travel file through the commissions and markup that are collected from each transaction. These amounts are initially calculated as forecasted profit, and become actual profit when a voucher/ticket is issued. Refunds reduce the profitability of the travel file and are deducted from both the forecasted and actual profit, once the refund is approved.

The Services section contains the following rows:

Non-confirmed: The total amounts of all the transactions that have the status Unconfirmed, Request, or Waiting list.

Non-ticketed/vouchered: The total amounts of all the transactions that have the status OK, but have not yet been ticketed or vouchered.

Ticketed/Vouchered: The total amounts of all the transactions that have been ticketed or vouchered minus approved refunds. The row can be expanded to show the details of each individual document (voucher, ticket and refund).

Unconfirmed refunds: The total amounts of all the refunds that have not yet been confirmed. The row can be expanded to display all the refunds that have been issued and not yet been confirmed.

Total (excl. unconfirmed refunds): The total of the Non-confirmed, Non-ticketed/vouchered, and Ticketed/Vouchered rows. Unconfirmed refunds do not affect the travel file profit.

The commission and markup amounts in the Non-confirmed and Non-ticketed rows are added to the Forecasted profit. The commission and markup amount in the Ticketed/Vouchered row is added to both the Forecasted and Actual profit.

The Services section displays both the selling price, tax, commission/markup (+VAT), and the net price that is paid to the supplier - not including tax (selling price - commission/markup).

Gross and net transactions are displayed as separate rows in the Services section when the expanders are open.

In the gross transaction row, amounts are only displayed in the Selling Price, Tax, and Comm/MU columns. The amount in the Comm/MU (+VAT) column is the difference between the selling price of the gross transaction and the supplier price of the net transactions.

In the net transaction rows, amounts are only displayed in the Comm/MU (+VAT) and Net columns.

The amounts that appear in this section are initially calculated as forecasted profit, and become actual profit when:

Vouchers are issued for the net transactions

An invoice is issued for the gross transaction

The Services section contains the following information when there are gross and net transactions in the travel file:

Non-confirmed: The total amounts of all the net and standard transactions that have the status Unconfirmed, Request, or Waiting list.

Non-ticketed/vouchered: The total amounts of all the transactions that have the status OK, and for which no financial documents have been issued (vouchers for the net transactions and an invoice for the gross transaction). When the row is expanded, you can view the total amounts for the net transactions and the amounts for the gross transaction.

Ticketed/Vouchered: The total amounts of all the net transactions that have been ticketed or vouchered and the gross transaction after an invoice has been issued minus approved refunds. When the row is expanded you can view the profit information on each individual document (voucher, ticket, invoice, or refund), which is color coded according to the type of transaction - gross or net.

Unconfirmed refunds: The total amounts of all the refunds that have not yet been confirmed. The row can be expanded to display all the refunds that have been issued and not yet been confirmed.

Total (excl. unconfirmed refunds): The total of the Non-confirmed, Non-ticketed/vouchered, and Ticketed/Vouchered rows. Unconfirmed refunds do not affect the travel file profit.

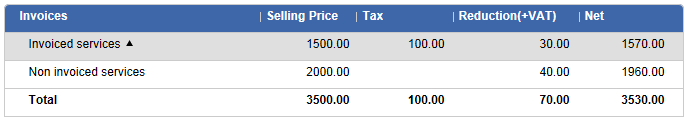

The Invoices section lists the breakdown of the amounts according to invoices. Invoices negatively affect the profitability of the travel file through the commissions that are granted to travel agents, and the reductions that are granted to corporate clients and direct sales. These commissions and reductions are initially deducted from the forecasted profit. Once an invoice is issued these amounts are deducted from the actual profit.

Transaction fees are added to both the forecasted and actual profit. When an invoice that includes transaction fees is issued, a separate tax invoice for the transaction fee is automatically issued. This tax invoice represents the profit gained from the transaction fee and is reported separately, and is displayed in the Summary section of the Travel File Profit page.

The Invoices section contains the following rows:

Invoiced Services: The total amounts of all transactions for which an invoice was issued. The row can be expanded to show the details of each individual invoice.

Non-invoiced Services: The total amount of all the transactions that have not yet been invoiced.

The Invoices section displays both the selling price, tax, commission/reduction (+VAT), and the net price that appear on the invoice (selling price + tax - commission/reduction).

The commission and reduction amount in the Invoiced Services row is deducted from both the Forecasted, and the Actual profit. The commission and reduction amount in the Non-invoiced services row is deducted only from the Forecasted Profit.

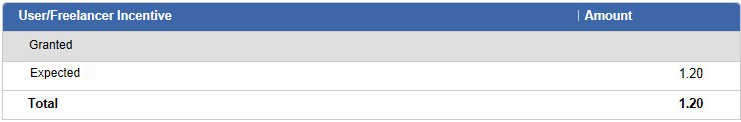

The User/Freelancer incentive section lists all the incentives that are granted to users and freelancers. These incentives reduce the profitability of a travel file because, like reductions, they are deducted from the profit. An incentive that is owed to a user or freelancer only appears in the travel file Profit page if a voucher has been issued for the transaction or a tax invoice has been issued for the transaction fee.

The User/Freelancer Incentive section contains the following rows:

Granted: Incentives are granted after you create incentive fee records in the User/Freelancer Reconciliation module. Incentive fee records can only be created for travel files with a balance that is equal or greater than zero. This row can be expanded to display the incentive fee records that have been created for users.

Expected: Incentives for transactions for which a voucher/ticket has been issued and transaction fees for which a tax invoice has been issued. Once an incentive is granted it moves from the Expected row to the Granted row.

Total: The total amount of all user/freelancer incentives - both expected and granted.

The incentive amount of the Granted row is deducted from both the Forecasted, and the Actual profit. The incentive amount in the Expected row is deducted only from the Forecasted Profit.

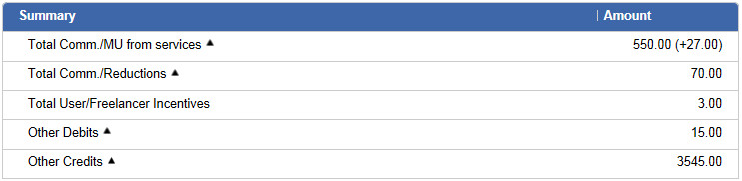

The Summary section lists the completely breakdown of all the amounts that affect the profit in the travel file:

Total Comm./MU from services: The total amount of commissions and markup from services. This is the amount that appears in the Total row of the Services section. This section can be expanded to display tax invoices issued for transactions with markup.

Total Comm/Reductions: The total amount of commissions granted to travel agents or reductions granted to corporate clients and direct sales. This is the amount that appears in the Total row of the Invoices section. This row can be expanded to display Agent Commission Invoices (ACI) that are issued for direct sales, and travel agents and corporate clients who receive net invoices.

Total User/Freelancer Incentives: The total amount of incentives granted to users and freelancers. This is the amount that appears in the Total row of the User/Freelancer Incentive section.

Other Debits: This section can be expanded to display documents that debit the travel file, such as tax invoices from transaction fees.

Other Credits: This section can be expanded to display documents that credit the travel file, such as receipts, and credit invoices that are issued to travel agents and corporate clients.

The amounts that appear in this section are included in the Forecasted profit.

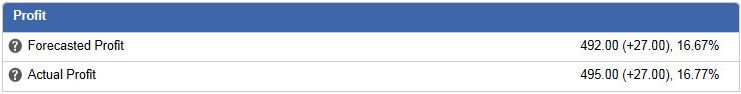

There are two types of profit:

Forecasted Profit: This is the profit that is calculated from the total of All commissions from suppliers, markup, transaction fees, commissions to travel agents, reductions, incentives, and credit notes issued between the travel file and general and discount accounts even though not all the financial documents have actually been issued.

Actual Profit: This is the profit that is calculated from actual financial documents that have been issued and incentive fee records that have been created.

After all documents have been issued in the travel file, and incentive records have been created, the Actual profit should equal the Forecasted Profit.

The profit is displayed as an absolute amount with VAT in parenthesis, followed by the profit percentage.

The profit percentage can be calculated from the net price or the selling price.

This is configured in the administration tools, in Setup - Database Definitions - Bookings, in the Travel File Profit section.

If the profit percentage is calculated from the net price, the percentage is the total profit amount divided by the total net prices. If the profit percentage is calculated from the selling price, the percentage is the total profit amount divided by the total selling prices.

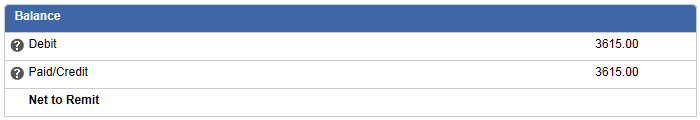

This section lists the total amounts for all the documents that affect the travel file balance.

In the Debit row, you can view the total sum of all documents that debit the travel file - vouchers, tax invoices, and debit notes (all types).

In the Paid/Credit row, you can view the total sum of all documents that credit the travel file - receipts, credit invoices, refunds, agent commission invoices, and credit notes (all types).