![]()

Note that the accounting transaction method you select will have a direct impact on how your website is set up and on your business operations as a whole.

The system supports two of the travel industry’s most commonly used methods for creating accounting transactions:

For databases that work with both domestic travel files and outgoing/incoming travel files, there is an additional option:

Descriptions of the two methods will be followed by sample accounting scenarios relevant to each method:

Agents Method: Sample accounting transactions for B2C hotel travel file

Sales and Purchases Method: Sample accounting transactions for B2C hotel travel file

Agents Method: Sample accounting transactions for B2B hotel travel file

Sales and Purchases Method: Sample accounting transactions for B2B hotel travel file

|

Note that the accounting transaction method you select will have a direct impact on how your website is set up and on your business operations as a whole. |

An accounting transaction is created for every activity in the travel file.

Profit is based on the margin between the buying price and the selling price. This margin is the product of the markup that is applied to the net price or the commission earned from the selling price.

VAT is calculated on your margin (as opposed to on your sales).

The travel file is the entity against which accounting transactions are posted.

For Example:

|

The same VAT percentage is applied to all services. While it is possible to apply VAT to certain products and not to others, in cases where it is applied it will always be the same amount.

The balance of a travel file will always reflect the entire activity of the travel file.

To apply this method in the system:

Go to Setup – Database Definitions - VAT.

Ensure that VAT on Travel Services is not selected.

Go to Financial - Export Data to General Ledger - General, in the Method section, select Agents.

Accounting transactions are created only for sales (invoices issued to customers) and purchases (supplier invoices for services rendered).

Profit is based on the difference between the buying price and the selling price.

VAT is calculated on your sales (as opposed to on your margin).

Sales and Purchases accounts are the entities against which accounting transactions are posted.

For Example:

|

In B2C mode, a general account named Direct Sales records payments made by customers.

The same VAT percentage can be applied to all services or different VAT percentages can be applied to different service types (e.g. flights 0%, hotels 15%, transfers 7.5%).

Different VAT percentages can be applied to different contracts for the same service type (e.g. hotels in London 15%, hotels in Paris 10%, hotels in the USA 0%).

If you have a credit note issued between two travel files, no accounting transaction is created.

To apply this method in the system:

Go to Setup – Database Definitions - VAT.

Select VAT on Travel Services.

Go to Financial - Export Data to General Ledger - General, in the Method section, select Sales & Purchases.

Accounting transactions created for Domestic travel files are created using the Sales & Purchases method.

Accounting transactions created for all other travel files types are created using the Agents method.

VAT is only applied to domestic travel files

If a credit or debit note is issued between travel files in which at least one of them is domestic, an accounting transaction record is created between the two travel files, and not with the Direct Sales general account.

You can create a separate invoice series for domestic travel files. For more information contact your project manager.

If a credit note is issued between two travel files, the behavior will be as follows:

If the credit note is between two Domestic travel files, no accounting transaction is created in the exported file.

If the credit note is between a Domestic travel file and another travel file type, an accounting transaction is created between the travel file and a direct sale account.

To apply this method in the system:

Go to Setup – Database Definitions - VAT.

Select VAT on Travel Services and in Country for Domestic purpose, select your country.

Select Apply VAT only to domestic travel files.

Go to Financial - Export Data to General Ledger.

In the General tab, in the Method section, select Combined.

Sample Details:

Your company has contracted a hotel for EUR 100.

You have applied a gross markup of EUR 50 and sell this hotel at EUR 150.

The VAT in your country is 15%.

ABC Hotels is the name of the supplier.

Accounting Transactions |

||

| Action | Account Transactions | |

Voucher issued to supplier |

Debit: Travel File Credit: Supplier Amount: 100 |

|

Tax Invoice issued automatically with the supplier voucher for your markup |

Debit: Travel File Credit: Income Account Amount: 42.37 |

Debit: Travel File Credit: VAT Output Amount: 7.63 |

Customer pays online by credit card |

Debit: Bank Credit: Travel File Amount: 150 |

|

B2C Invoice |

|

Posting B2C Account Transactions |

|

Sample Details:

Your company has contracted a hotel for EUR 100.

You have applied a gross markup of EUR 50 and sell this hotel at EUR 150.

The VAT in your country is 15%.

ABC Hotels is the name of the supplier.

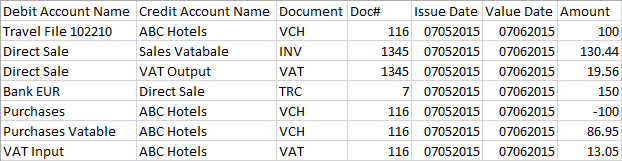

Accounting Transactions |

|||

Action |

Accounting Transactions |

||

Voucher issued to supplier |

Debit: Travel File Credit: Supplier Amount: 100** |

||

Customer invoice issued |

Debit: Direct Sales Credit: Sales Vatable Amount: 130.44 |

Debit: Direct Sales Credit: VAT Output Amount: 19.56 |

|

Customer pays online by credit card |

Debit: Bank Credit: Direct Sales Amount: 150 |

||

Invoice received from supplier; Invoice reference number is updated in the system. |

Debit: Purchases Credit: Supplier Amount: -100 ** |

Debit: Purchases Vatable Credit: Supplier Amount: 86.95 |

Debit: VAT Input Credit: Supplier Amount: 13.05 |

**These are temporary postings (the same amount in positive and negative values) for the full value of the supplier voucher. When the supplier invoice is received, the VAT is recognized and the voucher value is then split into the actual purchase amount and VAT input.

B2C Invoice |

|

Posting B2C Account Transactions |

|

Sample Details:

Your company has contracted a hotel for Euro 100.

You have applied a gross markup of Euro 50 and sell this hotel at Euro 150.

The VAT in your country is 15%.

Agents are entitled to 10% commission on this sale.

Beethoven is the name of the supplier.

Accounting Transactions |

||

Action |

Accounting Transactions |

|

Voucher issued to supplier |

Debit: Travel File Credit: Supplier Amount: 100 |

|

Tax Invoice issued automatically with the supplier voucher for your markup |

Debit: Travel File Credit: Income Account Amount: 43.47 |

Debit: Travel File Credit: VAT Output Amount: 6.53 |

Invoice issued to agent |

Debit: Agent Credit: Travel File Amount: 135 |

|

Agent Commission Invoice issued automatically with the agent invoice |

Debit: Agent Commission Account Credit: Travel File Amount: 15 |

|

B2B Invoice |

|

Posting B2B Account Transactions |

|

Sample Details:

Your company has contracted a hotel for Euro 100.

You have applied a gross markup of Euro 50 and sell this hotel at Euro 150.

The VAT in your country is 15%.

Agents are entitled to 10% commission on this sale.

Beethoven is the name of the supplier.

Accounting Transactions |

|||

Action |

Accounting Transactions |

||

Voucher issued to supplier |

Debit: Travel File Credit: Supplier Amount: 100** |

||

Invoice issued to agent |

Debit: Agent Credit: Sales Amount: 117.40 |

Debit: Agent Credit: VAT Output Amount: 17.60 |

|

Invoice received from supplier; Invoice reference number is updated in the system. |

Debit: Purchases Credit: Supplier Amount: -100 ** |

Debit: Purchases Vatable Credit: Supplier Amount: 86.95 |

Debit: VAT Input Credit: Supplier Amount: 13.05 |

**These are temporary postings (the same amount in positive and negative values) for the full value of the supplier voucher. When the supplier invoice is received, the VAT is recognized and the voucher value is then split into the actual purchase amount and VAT input.

B2B Invoice |

|

Posting B2B Account Transactions |

|