Go to Business Rules – User/Freelancer Incentive.

Click New Item.

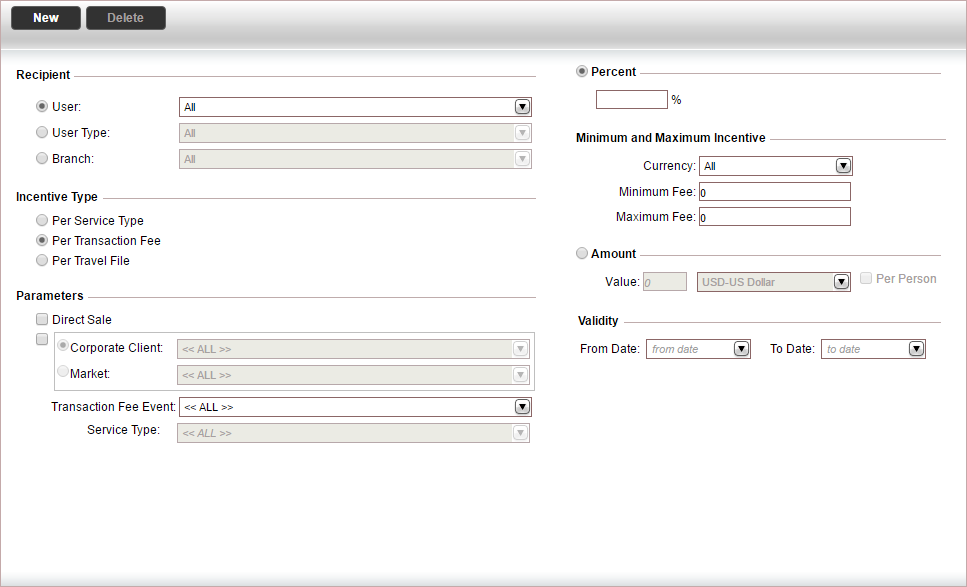

The New item page is displayed.

In the Recipient section, define the incentive recipient by selecting one of the following:

User and the user name from the drop-down list

User type and the user type from the drop-down list

Branch and the name of the branch from the drop-down list

In the Incentive Type section, select Per Transaction Fee.

The Parameters and Amount sections are automatically updated.

In the Parameters section, define the parameters of the user/freelancer rule using the table below.

Field |

Description |

Direct Sale |

Select this option if you want to apply the incentive to direct sales. |

|

Select this option, and then select either a travel agent/corporate client or a market, if you want to apply the incentive to travel files opened for either a travel agent/corporate client, or for a market. |

Transaction Fee Event |

Select the transaction fee event from the drop-down list. |

Service type |

Select the service type associated with the transaction fee from the drop-down list. This field is enabled only if you select a service related transaction fee event, such as Add Service. |

In the Amount section, select one of the following options:

Percent: To calculate the incentive as a percentage of the profit or selling price. This is the default option.

Amount: To provide a fixed amount as the incentive.

Enter the incentive percentage.

In the Minimum and Maximum Incentive section:

In the Currency field, select the currency of the incentive.

In the Minimum Fee field, enter a minimum incentive fee.

In the Maximum Fee field, enter a maximum incentive fee.

In the Value field enter a fixed amount, and select a currency.

If the amount is per person in the transaction, select Per Person.

In the Validity section, define the validity of the incentive rule.

The incentive rule is only applied if a tax invoice is issued during this period. The system compares the issue date of the earliest voucher in the transaction (including cancelled vouchers) to the dates defined in this section. If no dates are defined the incentive rule is always applied. Rule validity can only be defined for future dates.

Click Save.

Click here for a detailed example.

Click here for a detailed example.