Ensure that the relevant configuration is selected in the Configuration name field before defining any option on this page.

Click Save after updating any option on this page.

|

CreditGuard is a redirect payment gateway for handling credit card transactions. The gateway is PCI-DSS compliant.

CreditGuard can be used to handle US Dollar, euro and shekel transactions.

Separate bank accounts need to be defined for each currency.

In order to work with CreditGuard, you need to negotiate a separate agreement with the company. Once an agreement is reached, you will need to receive the following information in order to configure the system to work with CreditGuard:

URL

Merchant ID

Terminal Number

User Name

Password

In Setup - Database Definitions - Miscellaneous, select Enable storage of credit card details in Database.

|

It is recommended to consult your Project Manager for assistance in the configuration of the payment gateway. |

Go to Setup - Website Definitions - Payment options.

In the Payment Gateway section, in the Active credit card module field, select CreditGuard.

The CreditGuard expander is displayed

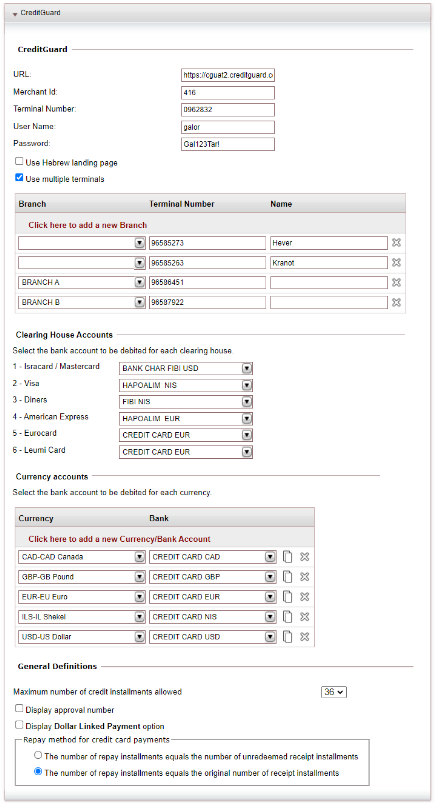

In the CreditGuard section, enter the credentials you received from CreditGuard:

URL

Merchant ID

Terminal Number

User Name

Password

If you want to use customers to be redirected to CreditGuard's Hebrew landing page, select Use Hebrew Landing Page.

If you want to use multiple terminals, select Use multiple terminals.

Click Click here to add a new branch.

In the Branch column, select the branch from the drop-down list. You can lieave this field empty if you want to define a terminal without branch.

In the Terminal Number column, either enter the terminal number you received from CreditGuard for that branch or enter a terminal number.

In the Name column, leave the field empty if you have chosen a branch. If not, assign a Terminal Name.

B2E only. If you have chosen more than one terminal, then you can choose which one to use from the Terminal Name drop down when issuing the receipt.

|

Credit card information is sent to the payment gateway for the branch associated with the user who issues the receipt. |

In the Clearing House Accounts section, for each clearing house, select a bank account to be debited from the drop-down list.

Select the bank accounts for each currency:

In the Currency table, for each currency you want to add (dollars, shekels, or Euro), click Click here to add a new currency/bank account.

In the Currency column, select the currency from the drop-down list.

In the Bank column, select the bank account to be debited for transactions in that currency.

In the General Definitions section:

In the Maximum number of credit installments allowed field, select the maximum number of credit installments allowed.

If you want to display an Approval Number field in the Credit Card Details page, select Approval Number.

If you want to display the Dollar Linked Payment option in the Credit Card Details page, select Display Dollar Linked Payment.

Select a Repay method for credit card payments:

The number of repay installments equals the number of unredeemed receipt installments: When issuing a repay for a receipt paid in installments, the number of repay installments equals the number of unredeemed installments on the receipt. The amount of each installment is the repay amount divided among the number of installments from last to first. If there no remaining installments, the refund is issued to the customer in a single payment.

The number of repay installments equals the original number of receipt installments: When issuing a repay for a receipt paid in installments, the number of repay installments equals the original number of installments on the receipt. The amount of each installment is the repay amount divided among the number of installments from last to first.

Click Save.

CreditGuard is a redirect gateway, when a passenger is about to enter payment, or when a B2E user is about to issue a receipt for a credit card payment, they are redirected to the CreditGuard secure interface, where they can enter the relevant billing information.

In the Reservations System, at the end of the booking process, the customer will need to select the card company before being redirected to the CreditGuard page. The system uses this information to calculate in advance any applicable transaction and installment fees.

When issuing a receipt for an individual passenger in the travel file, CreditGuard saves the passenger's credit card information and returns a token. This token can be used by repeat customers, instead of having to enter credit card information again. The token is double encrypted, and the only information displayed to the customer is the last 4 digits of the credit card.

It is possible to manually get the token for a passenger and save it in the system. The token information can be viewed in the Passenger Details page. When issuing the receipt, the user will be able to select the token, instead of having to type in the passenger's credit card information.

The system saves the token returned by CreditGuard in the travel agent/corporate client account where it can be used each time you issue a receipt for a travel agent/corporate client.

Users can issue refunds through CreditGuard, which credits the passenger's credit card. When issuing a refund, the only information that can be changed is the refund amount. All other information is taken from the original transaction.

CreditGuard supports installments and credit payment options. Installment payments are between the system and the customer and are defined in the Installments Fee module. Credit payments are between the credit company and the customer.

The number of installments and the Credit option are selected by the customer when entering the credit card information.

When a customer selects the Credit option in the Reservations System, interest defined in the Installments Fee module is not applied.

There is no limit to the number of repays that can be issued on a single receipt.

CreditGuard supports transaction fee rules created for local or foreign credit cards.

The amount the receipt is issued on, is the amount returned from CreditGuard. If the gateway returns a different amount, this is registered in the Travel File log.

When exporting data to the general ledger, the system can separate between the accounting transactions in each currency, and match each currency to the appropriate account.

There is an automatic process for updating the bank reference number on CreditGuard receipts, transfer receipts and remittances.

When payment fails, CreditGuard returns the reason for failure, and this is included in the error message shown to the customer.