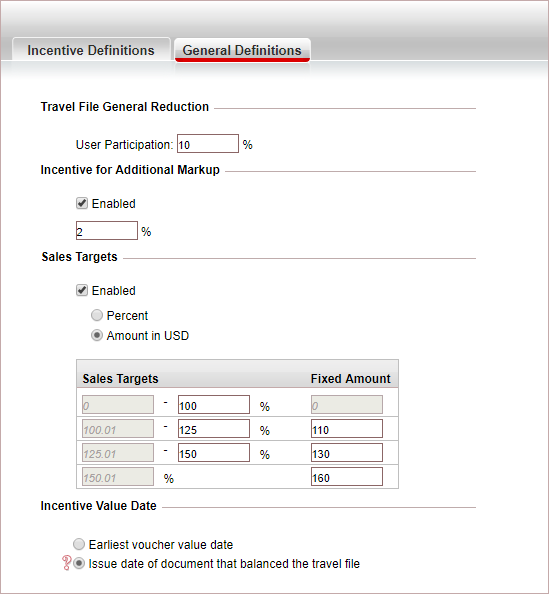

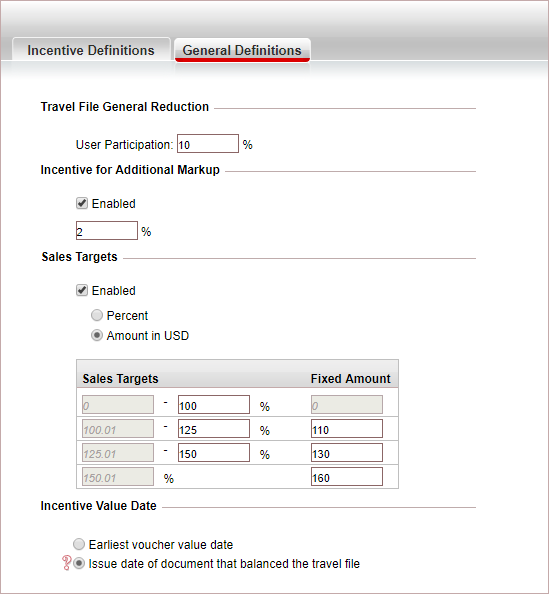

The General Definitions tab contains general definitions that apply to all user/freelancer incentives created through the system:

Travel file general reduction: Used for defining the user's participation percentage in general reductions applied to the travel file.

Incentive for additional markup: Used for defining an incentive percentage that applies to additional markup in the transaction.

Sales Targets: Used for defining up to four incentive target levels linked to the user/freelancer's monthly sales targets.

Incentive Value Date: Used for defining how the value date of incentive fee records is determined.

When a general reduction is issued in the travel file (in the Accounting section, by clicking Issue Documents - General Reduction), you can require that a percentage of the general reduction be deducted from the user/freelancer's incentives.

In the User Participation field, define the percentage of the general reduction to be deducted from the incentives. The percentage must be between 0-100.

For example, if the User Participation is 20%, in a travel file with a 100 USD general reduction, 20 USD will be deducted from the user/freelancer's incentives.

|

When creating incentive fee records, if the first incentive fee record created for the travel file is going to have a negative amount, no incentive fee record will be created as this means that money is going to be deducted from the user/freelancer. Later user/freelancer incentive fee records can be issued in a negative amount, for example as a result of refunds. For example, if 20 USD are deducted from a user/freelancer's incentives as a result of a general reduction, and the user only earned 15 USD, no incentive fee record is created during the reconciliation process. If the user had earned a 30 USD incentive, an incentive fee record is created for 10 USD (30 - 20 = 10). Now that the incentive has been granted, if there are refunds, additional incentive fee records can be created in a negative amount. |

The Incentive for Additional Markup section is used for defining an incentive percentage that applies to additional markup in the transaction.

To enable an incentive for additional markup, in the Incentive for Additional Markup section, you need to select the Enabled field and enter the incentive percentage you want to apply.

This incentive definition applies to all users/freelancers and to transactions for all service types.

If a value is entered in this section, when creating or editing a user/freelancer incentive rule, the Calculate incentive percentage from field is not displayed.

The additional markup incentive is calculated as follows:

If the reduction on the transaction is lower than the additional markup: The reduction is only deducted from the additional markup amount before calculating the incentive.

If the reduction on the transaction is equal or higher than the additional markup: There is no separate additional markup incentive and the reduction is deducted from the total amount of commission + markup + additional markup

In the Sales Targets section you can define up to four incentive sales target levels which are linked to the user/freelancer's monthly targets defined in the Target Definitions module.

To activate the incentive sales target levels, select Enabled.

The target incentive can either be a fixed amount in the travel file currency or a percentage by which their incentives are multiplied.

The first level defined in this section is the minimum level. If a user/freelancer does not meet this target level, no incentive is granted. In the other incentive levels you can define a factor by which to multiply the incentive.

The Incentive Value Date section is used for defining how the value date of the user/freelance incentive fee record is determined. The incentive value date determines the target month of the amount from which the incentive is calculated from.

There are two options for defining the incentive value date:

Earliest voucher value date: The value date of the earliest voucher in the travel file from which an incentive fee record is created.

Issue date of document that balanced the travel file: The issue date of the most recently issued document that balanced the travel file.

The following documents can be used to balance the travel file:

Voucher

Self-ticketing

Payment requisitions for cash transactions

Receipt/transfer receipt

Credit note

Credit invoice for travel agents/corporate clients or the covering receipt (most recent document)

|

This option also applies to negative incentive records created for refunds and repays. With reissued transactions, the value date of the new incentive fee record is the receipt (or other document) that balances the travel file. When this option is selected, in the User/Freelancer Reconciliation module, in the Create Data tab, in the Check section, the option Invoice Reconciled is selected and disabled. This prevents incentive fee records from being created for unreconciled credit invoices issued to travel agents/corporate clients. |