The system provides tools for managing the travel needs of Corporate Clients. Corporate clients often provide a large volume of traffic, have their own unique requirements and as a result negotiate separate business terms that apply to the transactions that are opened for their employees. These can include transaction fees, reductions, and markup, and special payment terms. Reports will need to be sent to the corporate client containing detailed information on the transactions made.

In order to work with a corporate client in the system:

You need to create an account for the corporate client

You need to define the business rules that apply to the corporate client - these can be transaction fees, reductions, and/or markup.

Once the corporate client has been set up, and the business rules have been defined, travel files can be opened for the corporate client in the Reservations System.

Invoices to the corporate client can be issued automatically or manually (for individual travel files or groups of travel files). Depending on the payment terms and credit limit, the invoices are either paid immediately (cash invoices) or reconciled periodically with the corporate client (credit invoices).

Once payment is received, the system enables you to reconcile the payment with the invoices that were issued to the corporate client.

There are tools that allow you to create reports for and receive business intelligence on corporate clients. These are useful for:

Sending information to the corporate client.

Analyzing the data in detail on the corporate client's travel files and balance

For more information, see Setup - Business Environments - Corporate Client/Travel Agent Accounts

You need to create an account for each corporate client you work with. In this account, you define the payment terms and create a credit limit for the corporate client. You can define separate payment dates for the services and transaction fees.

In this account you define whether the amount that appears on invoices issued to the corporate client is the gross amount of the transactions (prior to the deduction of the reduction), or the net amount (after the deduction of the reduction).

Corporate clients can be grouped together using Markets. By grouping corporate clients together, you can define business rules that apply to the entire group, and create reports and gather business intelligence on all the corporate clients in the report.

You can also separate between the corporate client making the reservation and the corporate client paying for the transaction.

There is an option to provide corporate clients with access to a dedicated website (b2b). In this website, depending on the authorization level, corporate client users can perform the following actions:

Search for services and make reservations

View reservations

View invoices

Some corporate clients attach huge significance to the type of information that is imported from the PNR into the travel file, such as cost center, and budget number. In the corporate client account you can define which information needs to be imported. This information will appear on invoices, and reports.

For more information, see Business Rules - Commission/Reduction Definitions, Business Rules - Transaction Fee Policy and Business Rules - Markup Definitions

There are three types of business agreements negotiated with corporate clients:

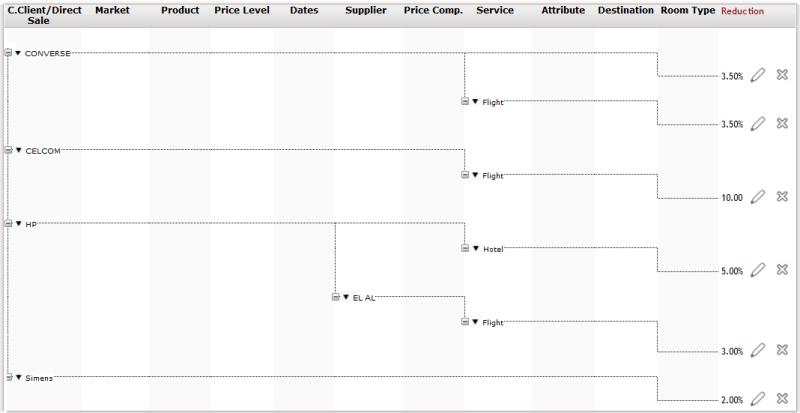

Reductions: The corporate client receives a reduction on the transactions purchased for its passengers

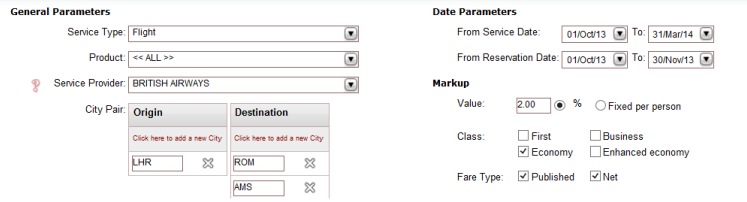

Markup: Markup percentages that are applied to the transactions purchased through the system.

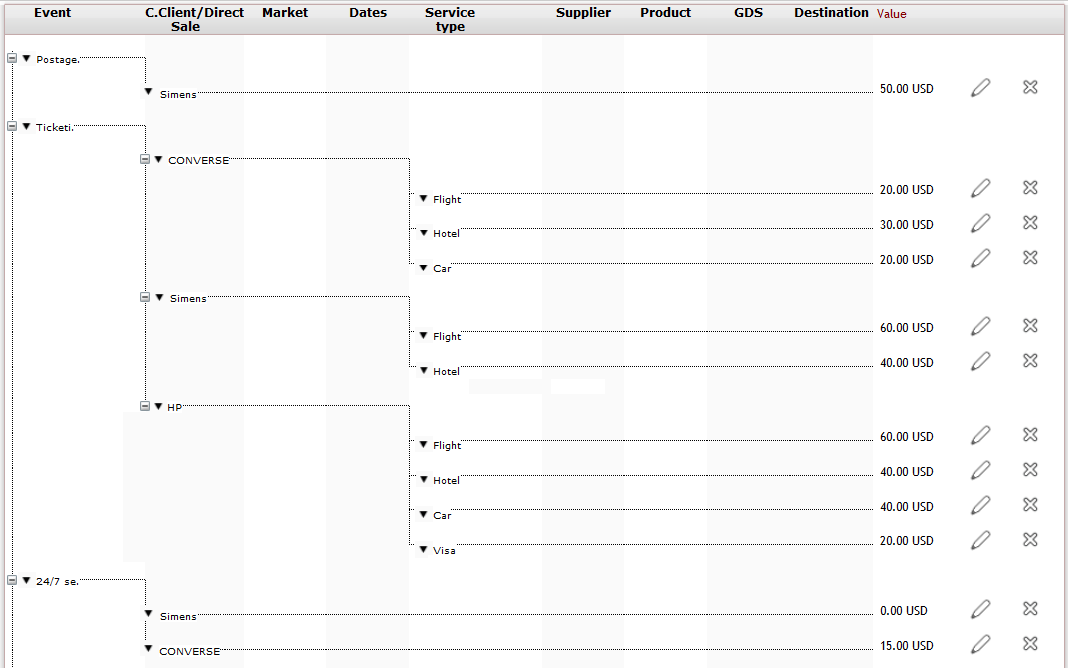

Transaction Fees: The corporate client is charged transaction fees for the actions relating to its travel files.

In order to enter the terms of these agreements into the system, you need to create rules in the Reduction Definitions, Markup definitions and Transaction Fee Policy modules.

The Reduction Definitions module allows you to create the rules that reflect the agreement negotiated with the corporate client. The reduction can be a percentage of a transaction or a fixed amount, and can be defined for specific parameters such as, destination, dates, service type, price level or supplier.

The Markup Definitions module allows you to create rules for applying markup to services sold through the system. The markup can either be a percentage of the transaction's selling price or a fixed amount, and can be defined for specific parameters such as service type, supplier, destination or reservation dates.

The Transaction Fee Policy module allows you to create rules for applying transaction fees that are charged to the corporate client according to the agreement you negotiated. Transaction fees can either be a percentage of a transaction or a fixed amount. The transaction fees can be charged automatically for actions performed in the travel files that belong to the corporate client, such as adding services, cancelling services, ticketing, or reissuing a ticket, according to the parameters that you define.

You can also create rules for issuing transaction fees manually, such as issuing a report, or making a B2E call. This includes the option of defining up to seven manual miscellaneous transaction fee events with names that you define. For example a transaction fee for seating.

In the Reservations System, you have the option of importing PNRs created in a GDS into the system. If you are working with Sabre GDS, you can use the ENS service to import PNRs into the system, and have travel files created and updated automatically.

The system offers three methods for issuing invoices to corporate clients:

Automatically issue the invoice when a transaction is ticketed

Manually issue the invoice in each individual travel file

Manually mass issue invoices for a group of travel files

You can define whether the invoice will include transaction fees, or whether invoices for transaction fees will be issued separately.

When issuing an invoice for a transaction in the travel file, the system checks whether the corporate client has remaining balance on their credit limit.

You can issue a periodic invoice to the corporate client detailing all the transactions that were made during that period.

There are two options for sending a periodic invoice to the corporate client:

Preview statement report: This report provides detailed information on all active invoices issued to the corporate client.

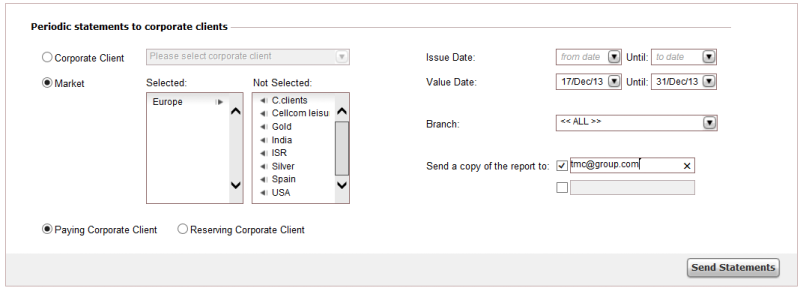

Send periodic statement to corporate client module: This module can be used for automatically generating periodic invoices to corporate clients. The module can send a periodic invoice to a single corporate client, or to all the corporate clients that belong to the same group.

For more information, see Financial - Corporate Client Reconciliation.

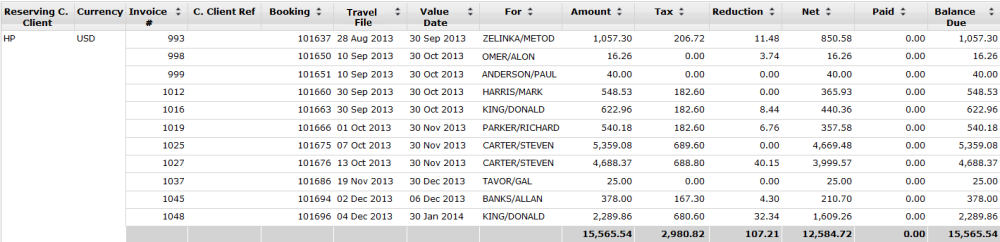

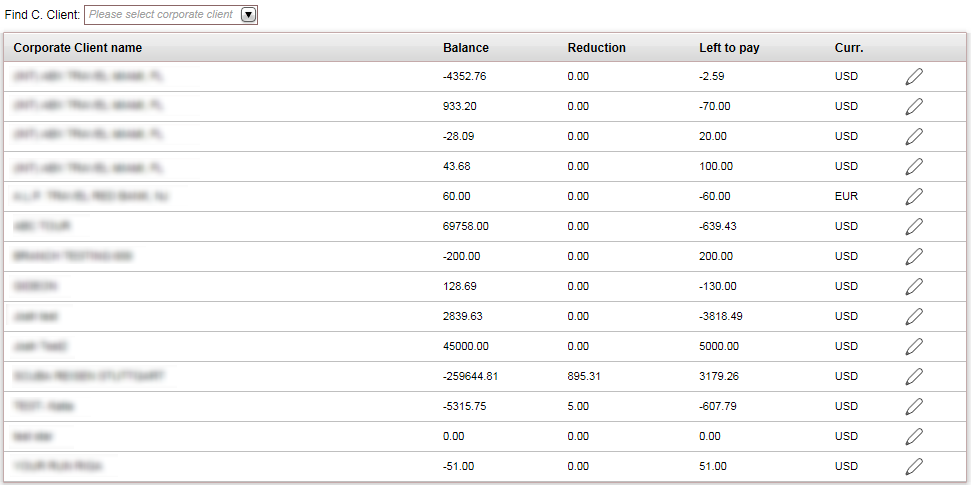

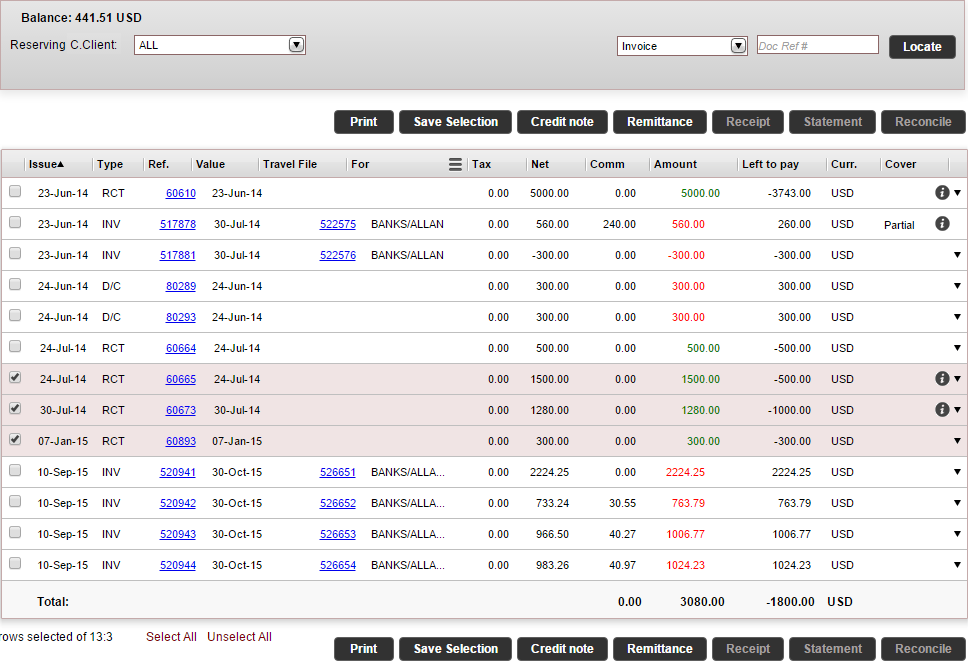

After payment is received, you need to reconcile the invoices issued to the corporate client. This is done in the Corporate Client Reconciliation module. In this module you can view a preview list of corporate clients and the amounts they owe, or search directly for documents pending for reconciliation belonging to a specific corporate client. The next step is selecting the uncovered invoices and issuing for them a receipt. If there is any balance left to pay on the receipt it can be used to cover future invoices.

Corporate clients can send an advance deposit, and the receipt that is issued for this deposit can be used to cover invoices on an ongoing basis.

You can use reports to send information to the corporate client and analyze the data on the corporate client's travel files and balance.

The following reports provide useful information on corporate clients:

Invoices to corporate client: Provides detailed information on all invoices issued to corporate clients

Invoice turnover: Provides detailed information on uncanceled invoices issued to a specific corporate client.

Accounting snapshot: Provides detailed information on the financial activity of a corporate client.

Aged debts: Provides detailed information on travel files opened for corporate clients with open debt.

Corporate report: Provides detailed information on all the transactions created for the corporate client.

The business intelligence module can be used for periodic analysis of the corporate client according to service types, airlines, destinations, and turnover. The information can be displayed on different levels, and is useful for comparing between years.

The following reports can be used analyze the data on the corporate client:

Profitability: This report allows you to analyze the profitability of transactions created for corporate clients.

Invoices: This report allows you to analyze data from invoices issued to corporate clients.

City pair: This report allows you to analyze the data on flight segments between cities, such as total amount of travel files, mileage, airlines, GDS, and suppliers

Sales vs. Target: This report allows you to analyze the data on the actual sales compared to the expected targets.