Go to Financial - Supplier Reconciliation.

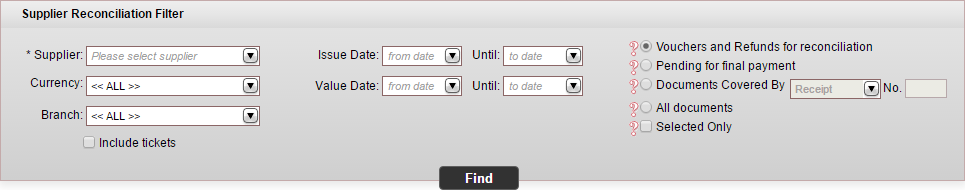

Enter the search parameters.

Field |

Description |

Supplier |

Select the supplier account. |

Currency |

Select the currency in which the documents were issued |

Branch |

Select the branch where the document was issued. You can only select the branches you have the user permit to view. |

Issue Date Until |

Enter the date range in which a financial document is issued |

Value Date Until |

Enter the date range in which a financial document is valued |

Default. Select this radio button to display vouchers and refunds that are not yet reconciled |

|

Select this radio button to display payment requisitions and debit notes that are not covered by a remittance and credit notes and tax invoices that need to be covered by a receipt. |

|

Documents Covered By |

Select this radio button to search for a specific payment requisition, receipt, transfer receipt or remittance, and select the document type and enter the document number. |

All documents |

Select this radio button to search for all financial documents. |

Selected only |

Select this option to search for financial documents that were previously selected and then saved (using the Save Selection button) |

Include tickets |

Select this option if the supplier has tickets, and you want to include them in the data displayed in your search results. By default this option is not selected, which means that the system does not search for tickets, effectively shortening the duration of the search. |

Select Vouchers and Refunds for reconciliation.

Click Find.

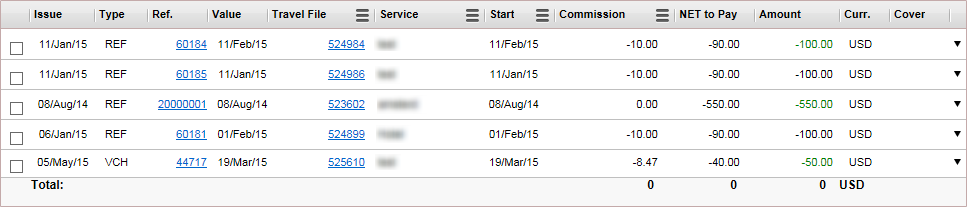

The financial documents are displayed in the results section with the data you requested.

Column |

Description |

Issue |

The issue date - the date on which the document was issued |

Type |

The document type: VCH for vouchers, PRQ for payment requisitions, RMT for remittances, REF for refunds, TXI for tax invoices, RCT for receipts, C/D for credit notes and D/C for debit notes. |

Ref |

The document reference number |

Value |

The value date - the date the document needs to be paid |

Travel File/Branch/Reservation/Supp Invoice/Income Type/Ticket Number. |

In this column you can select one of six options to

display, by clicking on the icon with the three bars (

|

Service Name/Passenger Name/Leading Carrier |

In this column you can select one of three options to

display, by clicking on the icon with the three bars (

|

Start/End |

In this column you can select one of two options to

display, by clicking on the icon with the three bars (

|

Commission/Published/Tax/ |

In this column you can select one of six options to

display, by clicking on the icon with the three bars (

|

Net to pay |

The net amount that needs to be paid to the supplier including airport/port taxes (taken from the Net to Remit field in the transaction. |

Amount |

The total amount on the document, including airport/port taxes and commissions (taken from the Total to Supplier field in the transaction) |

Curr. |

The currency on the document |

Cover |

The covering document. For example, a payment requisition (PRQ) covers a voucher (VCH), and is covered by a remittance (RMT). |

The document type of refunds is REF. In the Amount column, the amount for approved refunds is in green, and the amount for unapproved refunds is in black. Refund amounts are negative.

In the row of the refund you want to approve,

click ![]() and select Approve

Refund.

and select Approve

Refund.

A Price Breakdown dialog box appears.

This is the dialog box that appears for all services except flights. With flights, you can filter by passenger and remove passengers from the refund. Refunds for flights are usually approved in the travel file. |

Edit the amounts.

Click OK.

The refund is approved, the amount changes to green, and it can now be reconciled.