The Transaction Fees mechanism allows you to charge transaction fees for the services offered to customers. The mechanism is flexible: you can define that a single fee is charged for each travel file that is opened, or decide to charge smaller amounts for each action performed in the travel file, such as reserving a service, ticketing, changing a reservation, cancelling a service, reissuing a voucher/ticket - and you have the option of charging extra for 24/7 service.

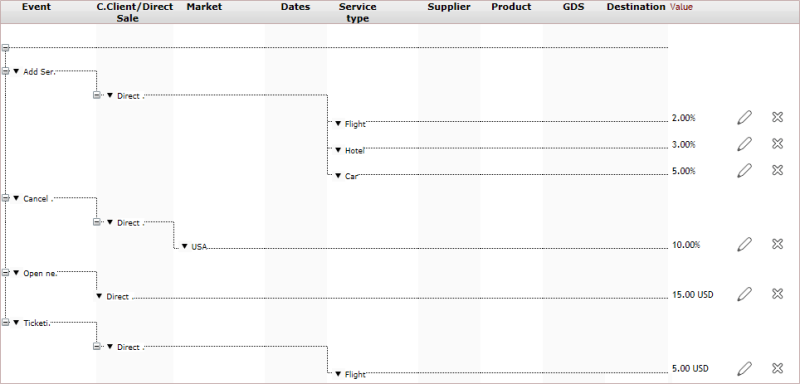

The system allows you to create business rules for adding transaction fees to a travel file according to the parameters that you define. You can define rules that automatically add a transaction fee to the travel file after specific actions, such as reserving, modifying, ticketing, or cancelling a service, and you can define rules that allow users to manually add transaction fees for services they perform, such as sending a package using a delivery company. You can define separate fees for direct sales, individual travel agents/corporate clients, and groups of travel agents/corporate clients, and separate fees for different destinations, services, or suppliers. The transaction fee can be a percentage of the transaction or a fixed amount.

With travel agents/corporate clients, you have the option of issuing a separate invoice for transaction fees.

For each transaction fee rule, you have the option of defining whether the transaction fee includes VAT. If VAT is applied, it is included within the transaction fee.

The system allows you to charge additional amounts to the transaction fee for actions that were performed after the office hours, or on days when the branch is closed.

Transaction fees are displayed in the travel file in the Transaction Fee section. Each transaction fee includes a date, time, description, status (is the transaction fee Fully covered or Partially covered in the invoice) amount, and if relevant, invoice and tax invoice.

After a transaction fee is created in the travel file, a tax invoice needs to be issued. You can define that the tax invoice be issued automatically when the transaction fee is created, or you can issue the tax invoice with the invoice.

With travel agents and corporate clients, you can define that a separate invoice be issued for transaction fees.

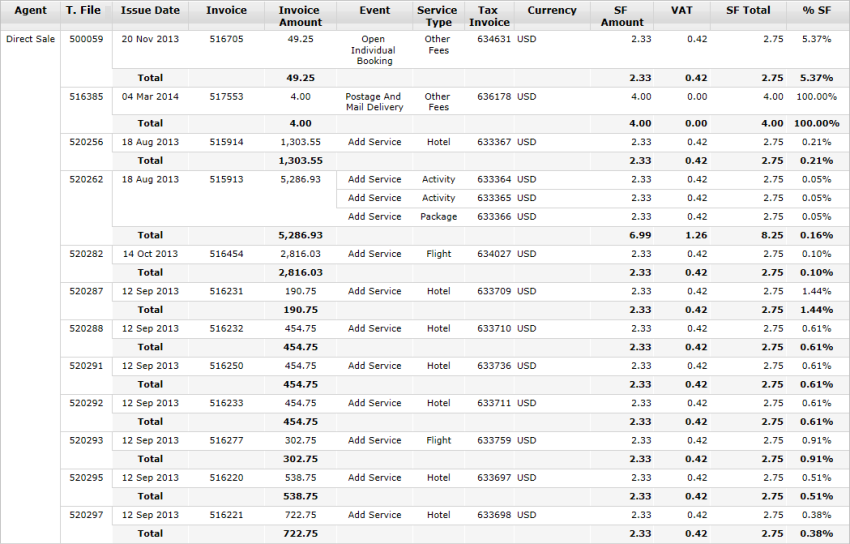

There is a Transaction Fee report that displays all the transaction fees in travel files opened for corporate clients, travel agents and direct sales for which a tax invoice was issued in a specified time period.